maryland earned income tax credit 2019

Allowing certain individuals to claim a refund of. 27 earned income credit allowable for the taxable year under 32 of the Internal Revenue 28 Code that is attributable to Maryland determined by multiplying the federal earned 29 income credit.

The Maryland Department of Human Services Family Investment Administration is pleased to announce.

. In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. Information regarding the States Earned Income Tax Credit EITC. Allowable Maryland credit is up to one-half of the federal credit.

Its free to sign up and bid on jobs. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than. Allowing certain individuals to claim a.

Earned Income Tax Credit EITC More In Credits Deductions. 2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the. 1 The law enforcement officer resides.

Visualize trends in state federal minimum wage unemployment household earnings more. February 4 2019 Assigned to. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit.

Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than. Beginning January 1 2016 law enforcement officers can claim an income tax subtraction modification for the first 5000 of income earned if.

If you qualify for the federal earned income tax credit and claim it on your federal. The 2019 Tax Year Earned Income Tax Credit or EITC is a refundable tax credit aimed at helping families with low to moderate earned income. Allowable Maryland credit is up to one-half of the federal credit.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. This alert addresses changes brought by passage of Chapter 40 of the Acts of 2021 concerning Income Tax Child Tax Credit and Expansion of the Earned Income Credit. Without a qualifying child you may claim the state earned income tax credit calculate federal earned income credit disregarding the minimum age requirement.

Ad Explore detailed reporting on the Economy in America from USAFacts. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Introduced and read first time.

Ways and Means A BILL ENTITLED 1 AN ACT concerning 2 Earned Income Tax Credit Individuals Without Qualifying Children 3. Earned Income Tax Credit For 2019. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit.

Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit. Allowing certain individuals to claim a refund of. The RELIEF Act also enhances the Earned Income Tax Credit for.

If your income is less than.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Earned Income Credit H R Block

Maryland Relief Act What You Need To Know Mvls

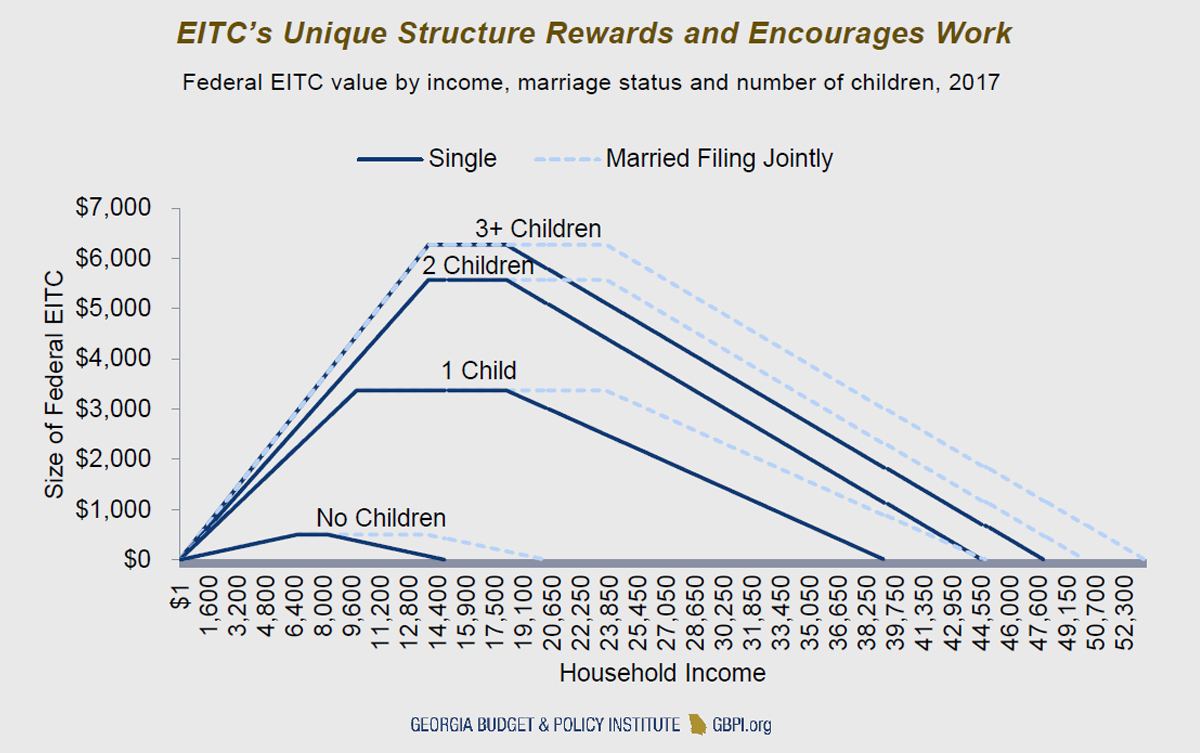

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute